How to Find Underpriced NFTs Using Rarity Rankings

January 23, 2022 - 11 min read

This article breaks down step-by-step how you can use data from rarity rankings to find underpriced NFT assets and make sure you don't overpay for an NFT. We use the popular Alien Frens project as a case study.

Introduction

A lot of people want to know the secrets of finding NFT projects before they explode. This takes work and consists of getting whitelisted for new project drops, discovering new projects, spotting projects that could blow up, studying the backstories of founders, and using arbitrage to find underpriced NFT assets.

Twitter users scream all day long that projects they own are undervalued, but how can you truly find an underpriced NFT asset? And how can you make sure that you don’t overpay for an NFT?

By using rarity rankings tools and OpenSea sales history data.

Rarity rankings are not definitive and not the only factor that matters for the price of an NFT, but understanding how to use the tools can help you spot NFTs that are underpriced or that you think could catch hold in the market.

It can also help you quickly navigate various traits in an NFT project (which is hard to do on OpenSea) and snipe assets you think might vibe with a group or community before others discover them:

Source: Twitter

Note: I do not own any assets in the Alien Frens project. This is not financial advice. It's information to help you do your own research. And remember, we encourage you never to spend money you can't afford to lose.

If you are interested in NFTs or own NFTs, we strongly encourage our readers to consider purchasing a hardware wallet, which starts at $59. Hardware wallets like the Ledger S or Nano X are the most effective ways to protect your NFT assets from scams. The following links contained below are affiliate links and we may receive a small commission if you choose to make a purchase. You can read my full affiliate disclaimer disclosure here.

If you want to protect yourself and your NFTs from scams and hacks, you can shop for Ledger Hardware wallets by clicking here.

If you are interested in purchasing cryptocurrencies so you can buy NFTs, we recommend using Coinbase. You can check out our full how-to guide to buying and selling an NFT here.

Let’s dive into the details that walk you through how to find underpriced NFT (and avoid overpaying for an NFT) assets step-by-step using different rarity tools using Alien Frens as a case study.

Step 1 — Go to Rarity.Tools and Search for the Project

Source: Rarity.Tools

For the purposes of this article, we are going to use Rarity.Tools, but you could use Rarity Sniffer or Rarity Sniper if the collection isn’t listed on a different rarity platform.

Once you click the project name you will be taken to a page that shows the 10,000 Alien Frens assets, the floor price (currently 2.3 ETH), and rankings for all of the assets:

Source: Rarity.Tools

The search results automatically rank by the rarest assets first, so I recommend clicking into a few to get a feel for what traits are rare in the collection. When you click on an asset, Rarity Tools will display a list of the attributes based on rarity and the number of assets that have that trait.

Step 2— Use Rarity Tools to Look at NFT Project Vitals

Rarity Tools shows some key information we need to review to make sure there’s demand for the project and that pricing hasn’t changed recently.

On the project home page to the right side, there’s data for 7-Day sales Volume, Total Sales Volume, 7-Day Aver Price, and the number of owners:

Source: Rarity.tools

7-day Volume: This shows us that there is demand for the project and ETH has recently been spent. There’s no benchmark for volume, but you can look at the total volume spent and compare it to the last 7-days of sales.

Total Volume: Some projects explode right when they launch and the majority of sales volume comes in the first two weeks but drops off. If total volume is high, but the last 7-day volume is low, that might mean some listings haven’t adjusted to less demand so you may be able to submit offers and get deals (relative to original volume and pricing).

7-Day Average Price: the 7-day average price is helpful to see what people are paying for the project to give you a sense of what assets may be underpriced and what the current market is valuing the project at.

# of owners: We’ve written before on how to check the distribution of a project using EtherScan but you can use Rarity.Tools to see that there are 6,261 owners of Alien Frens. Typically, the more owners the better. It means that fewer people own multiple assets from a project and have less control over the market price.

Step 3— Search Rarity Rank Based on Minimum and Maximum Listing Price

Rarity.Tools allow you to search for NFTs in a collection with a minimum price and maximum price based on the assets OpenSea listing regardless of rarity. Setting a budget will help you move faster and narrow in on being able to find an underpriced asset that you can afford.

We know that the floor price for this project is 2.3 ETH, so let’s say your budget is 5 ETH.

We will plug in 2.3 ETH (floor price) to 5 ETH so that we can see all the assets that are within our budget.

Rarity.Tools will show the assets ranked by rarity, which is why we want to enter our minimum price as the floor price in case any rare assets are underpriced:

Source: Rarity.Tools

592 NFTs fall between 2.3 ETH and 5ETH and we can see that the rarest NFT is #198, which is priced at 5 ETH.

Step 4— Find NFTs with Lower List Price Compared to Similar-Ranking Assets

Source: Rarity.Tools

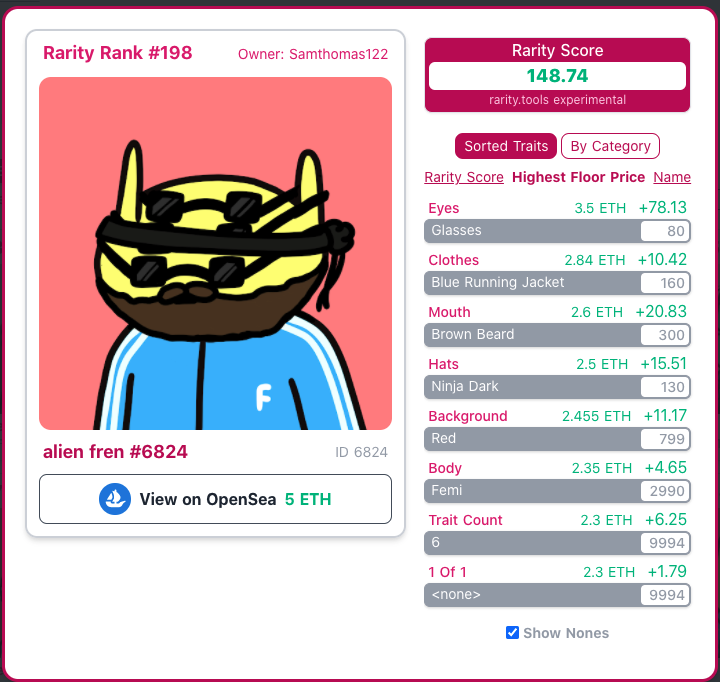

Alien Fren #6824 is ranked #198 in the collection and is priced at the top of our budget: 5 ETH.

However, there are a few other listings with a worse rarity rank that are similarly priced (4.5 ETH and above) so we’ll pick this asset to dig in a little further.

We are going to use Rarity.Tools to figure out the floor price of assets with the glasses attribute and see comparative rankings.

On the left-hand toolbar, scroll to the bottom and look for Traits. Under traits, select Eyes → Glasses:

Source: Rarity.Tools

This will help us quickly see the floor price of an asset with the Glasses trait and the corresponding rankings.

Adjust the Sort By tab to Price: Low → High to see the lowest price assets with Glasses:

Source: OpenSea.io

Out of the 14 NFTs returned in the search results by Rarity.Tools, Alien Fren #6824 has the second-best ranking and has the 3rd lowest price.

Alien Fren #3535 is ranked #147 but is priced at 15 ETh, and Alien Fren #6824 is ranked #198 and is priced at 5 ETH.

Unfortunately, Rarity Tools does not have sales data built-in, but it helps to see what the assets with similar attributes and rarity rank are listed for.

Step 5— View the Asset on OpenSea to See Sales History for Assets with Similar Traits

Because Rarity Tools does not have sales data (only list prices), we will want to do diligence using OpenSea for sales history.

Click on asset #6824, which is ranked 198 out of the 10,000 assets and has a rarity score of 148.74. Its glasses (only 80 Alien Frens have this), Blue Running Jacket (only 160 have this), Brown Beard, and Ninja Hat all contribute to its rarity.

Start by clicking on “View on OpenSea”:

Source: OpenSea.io

Once the OpenSea page loads, we want to click on “Properties”:

Source: OpenSea

You can see all the traits of the assets with percentages of the supply that have those assets.

Click on the highest rarity trait based on the percentages. In this case, Glasses because just 0.80% of Alien Frens have this trait.

We can now see that 80 assets have glasses and #657 has the lowest list price at 3.5 ETH:

Source: OpenSea

Update: at the time of this writing, asset #657 was priced at 3.5 ETH but adjusted its price to 7 ETH. Someone must have followed these steps and realized they underpriced their asset.

When we refresh the data, we see that the lowest price is now 4.44 ETH and the asset we are looking at is the second-lowest at 5 ETH:

Source: OpenSea

We then want to filter for “Highest Last Sale”:

Source: OpenSea

Note: It’s unlikely that the highest last sales sold because of the glasses attribute. They likely have other rare attributes but it gives us a sense of the top-end of the traits sales.

Now let’s filter for Recently Sold:

Source: OpenSea

We can see that recent sales have ranged from 2.5 ETH to 15.99 ETH, but other attributes play a role in the pricing. 5 ETH may not be underpriced because other assets with glasses have sold for 2.5 ETH, but we want to dig a little further in step 6.

Step 6— Find the Rarity Rank of Sales Above List Price

The next step we need to take in order to see if this 5 ETH asset is underpriced based on recent data is to look at the rank of assets that have sold for 5 ETH and above that have the glasses trait.

We’ll use the same screen in OpenSea filtered to recent sales and we’ll start with asset #4626, which last sold for 7 ETH:

Source: OpenSea.io

Note: Check the date of the last sale to make sure it’s recent. Click on the asset and OpenSea will display a Price History graph to the right:

Source: OpenSea

This shows that the asset was sold on January 19th, 2022 for 7 ETH and is relevant for our analysis because it was only a few days ago.

The next step after confirming the date of the sale is to type in the asset ID (4626) into the ID field under the project name:

Source: Rarity.Tools

In this case, the asset is ranked #628 with a rarity score of 120.05:

Source: Rarity.Tools

This asset sold for 7 ETH but has a worse ranking than #6824, which is ranked 198th.

It could be that the market has a personal preference for a specific asset, or people are unaware of how rare the assets are.

I recommend following these steps to look up the rarity of a few other assets that sold for more than 5 ETH to see how they compare.

If you have a budget of 5 ETH and aren’t afraid of it going to zero, and want an Alien Frens, and have verified at least 2–3 sales above 5 ETH from worse-ranked assets, this could be a good buy at the price based on its rarity ranking.

Step 7— Find the Rarity of Floor Priced NFTs

If you have a lower budget and can only afford a floor asset, you could filter for assets priced at the floor and simply pick the one with the highest rank (if you like it).

In this case, we’ll search for assets using a minimum price of 2.3 and a maximum price of 2.3:

Source: Rarity.Tools

This returns 7 matching assets, but some rarer than others:

Source: Rarity.Tools

If you can only afford the floor price of a project, using the technique can help you move fast and find the rarest asset available at that price. In this case, Alien Fren #6085 is ranked 5,901 and is 2.3 ETH. The next highest rank is #7979.

Conclusion

When people make claims that a project is undervalued, it is speculative. It’s their opinion and belief that a project is priced too low, but there isn’t really data to back it up.

Searching for underpriced NFT assets is less speculative in that you are using data and asymmetric information (you know something other people don’t) to make a decision.

However, the market moves fast. If a project that was hot starts to cool off, people may feel more comfortable buying a floor asset than something priced at 5 ETH.

Market preferences also matter significantly — you have to decide, is the glasses trait that only 80 Alien Frens have worth a market premium?

Newsletter

Enter your email address below to subscribe to my newsletter

latest posts