Explaining the Rise of Bored Ape Yacht Club - The NFT Project Making History

September 6, 2021 - 16 min read

I do a deep dive on the Bored Ape Yacht Club NFT project and provide some explanations for its meteoric rise in the NFT space over the past 10 months.

If you enjoy this article and want to get weekly notifications when new posts go live, subscribe to my e-mail list here.

Also note that if you are interested in NFTs or own NFTs, we strongly encourage our readers to consider purchasing a hardware wallet, which starts at $59. Hardware wallets like the Ledger S or Nano X are the most effective ways to protect your NFT assets from scams. The following links contained below are affiliate links and we may receive a small commission if you choose to make a purchase. You can read my full affiliate disclaimer disclosure here.

If you want to protect yourself and your NFTs from scams and hacks, you can shop for Ledger Hardware wallets by clicking here.

If you are interested in purchasing cryptocurrencies so you can buy NFTs, we recommend using Coinbase. You can check out our full how-to guide to buying and selling an NFT here.

Article updated on 6/22/2022.

Introduction

The Bored Ape Yacht Club NFT project consists of 10,000 unique assets of Bored Apes. The project was released on April 23rd, 2021 for a mint price of .08 ETH, which was $200 US dollars at the time. Bored Ape Yacht Club sold out within 12 hours since it started minting.

The project has rocketed to a 99 ETH floor price, which is over $257,000!

That's an increase of 128,600% in value at the time of this writing since mint.

In just 9 months, Bored Ape Yacht Club is now 2nd in total volume sold on Opensea with 379,912 ETH which is over $1 billion in sales.

In September 2021, a Gold Bored Ape sold for $2.25 million and a current bundle of Apes for sale at Sotheby’s auction house has a $19 million bid with just under 3 days left to go. That’s $1 million higher than the top end of Sotheby’s estimate.

Update (12/27/2021): We saw the most expensive Bored Ape Yacht Club sale for Asset #2087 when it sold for 769 ETH 3 months ago. At the time of purchase, that was equivalent to $2.32 million dollars.

Bored Ape Yacht Club has been featured on CNN.com and The New Yorker and athletes like Steph Curry, Dez Bryant, and Von Miller have purchased Apes and display them as their Twitter Profile Pictures.

Jimmy Kimmel, Post Malone, Snoop Dogg, and other high-profile celebrities have aped into Bored Ape Yacht Club. Eminem is using his Bored Ape Yacht Club as his Twitter profile picture along with soccer superstar Neymar, who has 55.8 million Twitter followers. Justin Bieber acquired a Bored Ape for 500 ETH and shared the NFT on Instagram which garnered over 1.7 million likes.

You can buy Bored Apes on Opensea.io by clicking here, but the current floor price (lowest price for sale) for the project is 99 ETH (~$257,000).

In this article, I’m going to break down what this project is and a few reasons why Bored Ape Yacht Club went off and emerged as a blue-chip NFT in a matter of months.

Please remember, this is not financial advice. I do not own any Bored Apes and do not recommend spending money you can’t afford to lose on NFTs.

What is Bored Ape Yacht Club?

The Bored Ape Yacht Club is a set of 10,000 Bored Ape assets derived from 172 unique assets and was launched to the public by Yuga Labs in April of 2021.

The first Bored Ape Yacht Club NFT was minted on April 23rd, 2021 at 9:56:11 pm UTC, which is 4:56:11 pm EST by Emperortomatoketchup.eth.

Source: Opensea.io

In the first month of that launch, there were just 35 total transactions on the secondary market for an average sale of $313.07. By August, that shot up to over 3,300 transactions at an average sale of $89,602.

Many in the NFT world (and observers outside of the world) wonder about utility: is it really just a JPEG or is there something more?

The Bored Ape Yacht Club roadmap, a document containing the goals and benefits to holders of an NFT project, listed a few goals:

(1) Release “Caged Apes” — 5 apes held back from the initial sale would be airdropped to random Ape holders. The incentivized holding an Ape for a chance to win a rare asset

(2) The creation of a YouTube channel and LoFi Radio

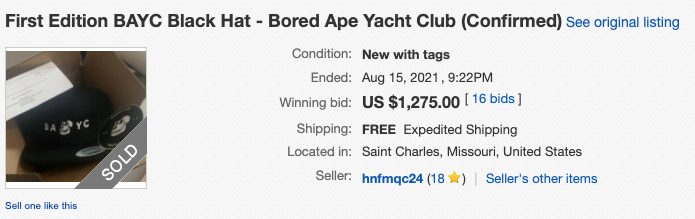

(3) Member Exclusive Bored Ape Yacht Club Merchandise (which has been released and commands premium pricing)

Source: eBay

(4) A treasure hunt with a 5 ETH (~$20,000) prize attached to it

(5) Liquidity Pool — a portion of funds set aside to buy floor priced Apes for those who need to sell to get liquid assets

(6) Mutant Ape NFT drop — a free airdrop of mutant serum to mutate an Ape to create a new asset

(7) Bored Ape owners have full commercial rights over their Apes if they want to brand their own projects

The creators also surprised its members with the drop of the Bored Ape Kennel Club, a collection of 10,000 companion dogs to Bored Apes, for free. 2.5% of secondary sales in the first 6 weeks of this project were donated to no-kill animal shelters.

The current floor price of those assets is 9.98 ETH ($26,000) with a record sale of 75 ETH ($292,500) for a golden puppy:

Source: Opensea.io

As the project grew in popularity, so did its secondary assets from the merchandise to the Bored Ape Kennel Club, to Mutant Serum and Mutant Ape Yacht Club.

The Mutant Ape Yacht Club (created by combining an NFT airdrop with original apes) is currently at a floor price of 23.5 ETH ($61,100) with the highest last sale of 350 ETH ($1.36 million):

Source: Opensea.io

Simply holding a token from this project earned you additional assets that have taken off in value from being associated with the Bored Ape Yacht club NFT project.

Those who hold the Ape tokens have also been meeting up in person and there’s plenty of talk about future events exclusive to Bored Ape holders.

Bored Ape Yacht club has become a powerhouse brand backed by celebrities, athletes and has met the requirements to be auctioned at global prominent art houses like Sotheby’s and Christie’s.

Want to stay ahead of the NFT market? WenAlphaText.io sends real-time text alerts when an NFT wallet purchases an NFT. Learn more here.

Why Is Bored Ape Yacht Club so Successful?

There are thousands of NFT avatar (profile picture) projects that have launched in the past 6 months, but none have held a candle to the performance of Bored Ape Yacht Club.

The only NFT avatar project that tops it is the “OG” CryptoPunks avatar project launched in 2017 which currently has a floor of 96.11 ETH ($378,101.55).

So, why did Bored Ape Yacht club rise to the cream of the crop out of a sea of projects?

Art is subjective, so there won’t ever be a formula to predict the rise of an NFT project. Some of it is momentum and the “vibe” of the art. After being heavily involved in NFTs over the past few months and producing detailed breakdowns of other NFT projects, I have a few theories with some supporting data to help us better understand the phenomenon.

(1) BAYC Entered The Market Early

When Bored Ape Yacht Club launched in late April, there were around 37,000 active wallets on Opensea.io. By the end of August 2021, there were over 116,000 active wallets. That’s 213% growth.

April might not seem like that long ago, but the NFT timeline is crunched because the market moves so fast.

In the fall of 2020, NBA Topshot, an NFT project that featured video assets of players started heating up and made a statement about the potential of NFTs in our culture.

In March 2021, Christie’s Auction house set a world-record sale of an NFT at $69,346,250 for Beeple’s EVERDAYS: THE FIRST 5000 DAYS, 2021.

In May 2021, Christie’s Auction House sold 9 CryptoPunks for $17 million.

The Bored Ape Yacht Club launch was smack in the middle of those two game-changing sales and was pre “NFT summer” before the rush of new projects flooded the market.

This didn’t guarantee its success — the art, the vibes, the execution, all matter. But BAYC had a head start and less competition at launch.

The project only had 24 unique buyers on the secondary market in April, but by May, this exploded to 3,269 unique buyers.

My theory is that the CryptoPunks headline inspired people to look for “the next” profile picture NFT project and BAYC was sitting there at an affordable price (.69 ETH in May) and not much competition.

(2) Compounding Social Capital

Many people who don’t “get” NFTs like to say they can right-click and save images and own the same asset. They fundamentally do not understand authenticity, rarity, and honest status signals.

Simply put, owning an original BAYC puts you into a social club and one that is much more visible than driving a luxury vehicle around your neighborhood.

Changing your avatar on Twitter to a Bored Ape puts you in the same club as Steph Curry and others, and it is a form of social proof: you know what you’re doing when it comes to NFTs and have the capital to afford one.

Only people in your local neighborhood see you driving your luxury car around the neighborhood, whereas millions of people with an internet connection can see your NFT avatar.

As more and more people started buying Bored Ape Yacht Club assets (5,616 unique buyers in April and May) the capital and community became larger in size and more widespread.

By July, The New Yorker took notice of Bored Apes taking over Twitter, formalizing the assets “status” in the digital world. In August, the average sale price for a Bored Ape went up to $89,602.26 from $13,769.52 from the previous month.

(3) An “OG” Community Base

It may seem silly, but those who were involved in NFTs in April, May, and June entered the market at a really ripe time before it exploded. Many projects at the time were affordable and have since gone up in value significantly.

This is pure theory, but it likely means 2 things:

(1) There are Bored Ape holders revered for their NFT prowess and thus become influencers (even if they don’t promote the project)

(2) Early Bored Ape holders are more likely to have ETH capital out of sheer market-wide appreciation

Again, this is a theory. It may be completely inaccurate, but I’ve seen this pattern in other Discords. People look to those who have been successful for advice and watch what they buy (and copy it if they can afford to). It’s more likely that those involved in those months had some better luck getting into NFT projects that have appreciated in value significantly.

(4) Ethereum (Ether) Lost Value

Ether (the currency for the Ethereum blockchain) peaked in May, nearly reaching $4,000 before dipping below $2,000 in late June. Anecdotally speaking, when the price of Ether rises, NFT sales seem to slow down. It’s harder and more expensive for new people to obtain Ether and people likely seek liquidity to invest in the rising asset.

When you invest in NFTs, this is a dynamic you need to be aware of. Ether is still an investible asset and the market may view it as more valuable than parking it in NFT projects, which can quickly become illiquid (you can instantly sell Ether, but you may need to wait to sell your NFT).

The average sale for a Bored Ape increased 360% from May to June, from 0.6985 ETH (~$2,794) to 3.21 ETH (~$6,420).

It’s worth noting that there were 3,269 unique buyers of Bored Apes in May and 2,347 in June, which was significant distribution and nearly 10% of active wallets on Opensea.

(5) Exploding NFT Market

From April 2021 through January 2022, the Bored Ape Yacht Club hasn’t seen a dip in the average sale price of its assets:

April: $313.07

May: $2,081.48

June: $7,470.43

July: $13,769.52

August: $89,602.26

September: $166,679

October: $170,016

November: $219,506

December: $253,261

January: $295,446.13

It took Bored Ape Yacht Club 4 months to blow up.

The project has increased in value for 9 straight months. This is an atypical behavior: usually, we see increases followed by some correcting dips.

Active wallet activity steadily increased during this time period, reaching 116,000 at the end of August, and there were a few record CryptoPunk sales in August and Visa even jumped in with a CryptoPunk purchase.

BAYC had 4 months of distribution before the market got really hot, and I believe (again, apart from the art and vibes, which is a big part of the equation) that being “early” and establishing their community put them in a perfect position for the market to place a premium on the assets.

There were many different social proof entry points as well — athletes buying the project, features in magazines like The New Yorker, that provided an additional marketing and awareness boost for the project.

(6) Behind The Creators of Bored Ape Yacht Club

Yuga Labs was founded in February, and all four of its creators are anonymous, yet they are on pace for nearly $1 billion in revenue within a year. Yuga is named after the villain in Zelda whose power is turning himself and others into two-dimensional art. The founders are all real-life friends from different backgrounds - Jewish, Cuban, Turkish, and Pakistani.

They started working on Bored Ape Yacht Club in February of 2021 and now have 11 full-time employees working on the project.

Typically, I would not advise buying a project from anonymous founders, as we’ve seen projects crumble because creators lied about who they were.

Since Bored Ape Yacht Club has blown up, the founders have shared more about themselves. You can read their Q&A with Farokh here.

Two of the founders were friends and used to drink together and discuss writers while living in Miami. One was in a Master of Fine Arts program and both were keeping an eye on crypto in 2017.

They wanted to get involved but weren’t technical. They were creatives and storytellers.

Once NFTs arrived, they saw an opportunity to get involved and they partnered with two other founders who could help with the technical aspects. The founders spoke about their online gaming background in MMPORGs (massive multiplayer online role-playing games) and how that led them to see an opportunity in digital assets.

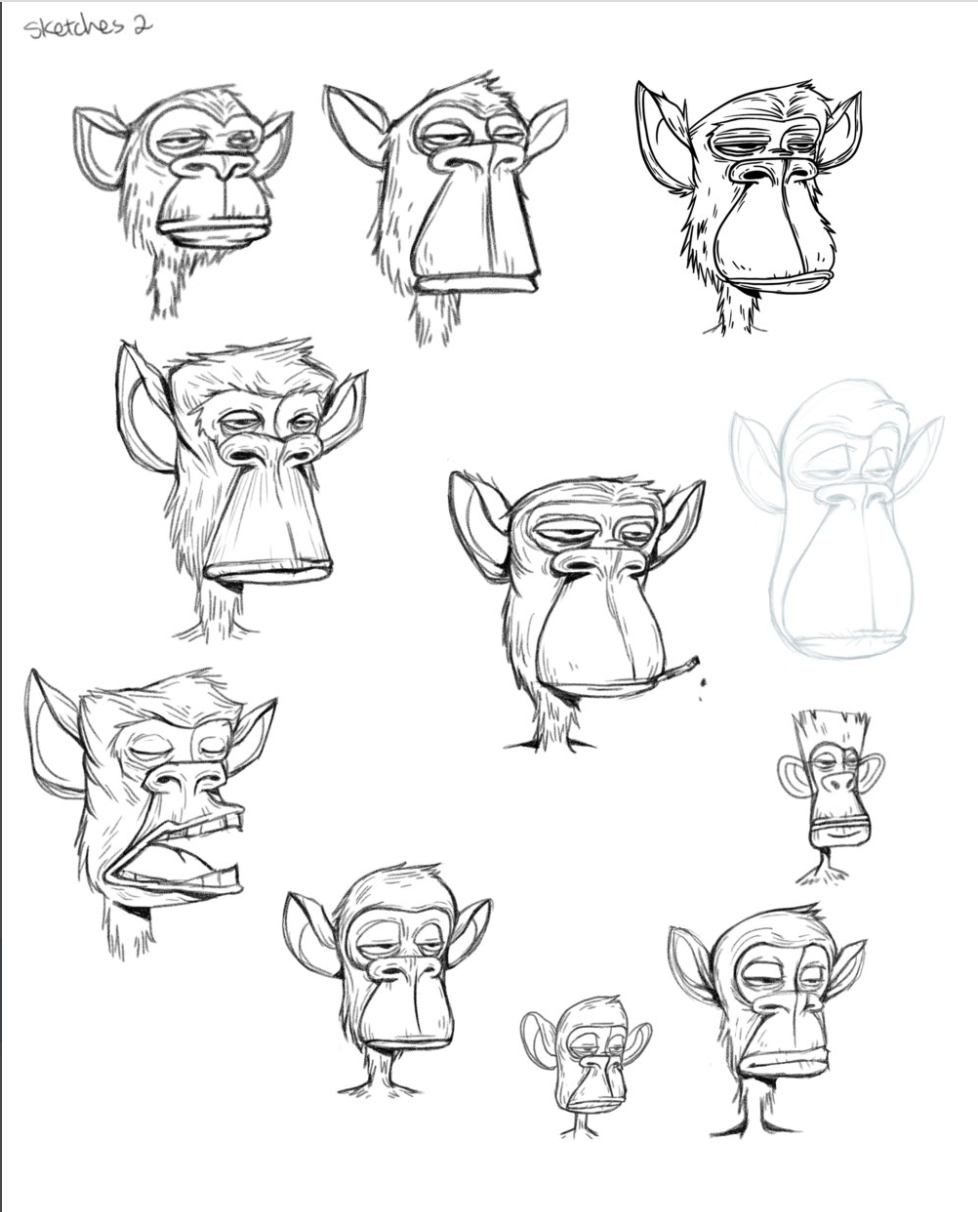

The female artist who designed Bored Ape Yacht Club, received a million-dollar bonus for her work also released sketches of the first Bored Ape designs:

Source: Twitter

These are the first designs of Bored Ape Yacht Club that would later become one of the most recognizable power-house NFT projects in a short amount of time.

(7) Commercial Rights

Earlier this month (December) a well-known CryptoPunk holder, Punk4156 decided to sell off a high-value collection because CryptoPunk holders are not granted commercial access rights to their assets.

Bored Ape Yacht Club is an established brand, and is recognized as a top income-earner of any talent on earth. If you consider musicians, artists, actors, and actresses as talent, Bored Ape Yacht Club joins this elite club.

There's a play-to-earn game on the way using the brand. Neil Strauss (The Game), a world-famous author (10 Best Sellers) is going to write a book about Bored Ape Yacht Club. Adidas partnered with Bored Ape Yacht Club.

Not only does owning a Bored Ape asset put you in an elite company, but it also gives you ownership of an asset in one of the fastest-growing brands in the world.

You own the talent, and you could use it however you please. Want to have your asset featured in a commercial for a local company? You could charge for that. Want to have a major brand sponsor your Bored Ape asset? You could charge for that.

Do you want to create a clothing line featuring your Bored Ape asset? You could start a business with the asset as your brand.

One Twitter user, a holder of Bored Ape, created Bored Ape IPA and used his asset to brand the can:

Source: Twitter

As the Bored Ape Yacht Club brand continues to go off, so will opportunities for its holders to make royalties and payments for the use of their assets.

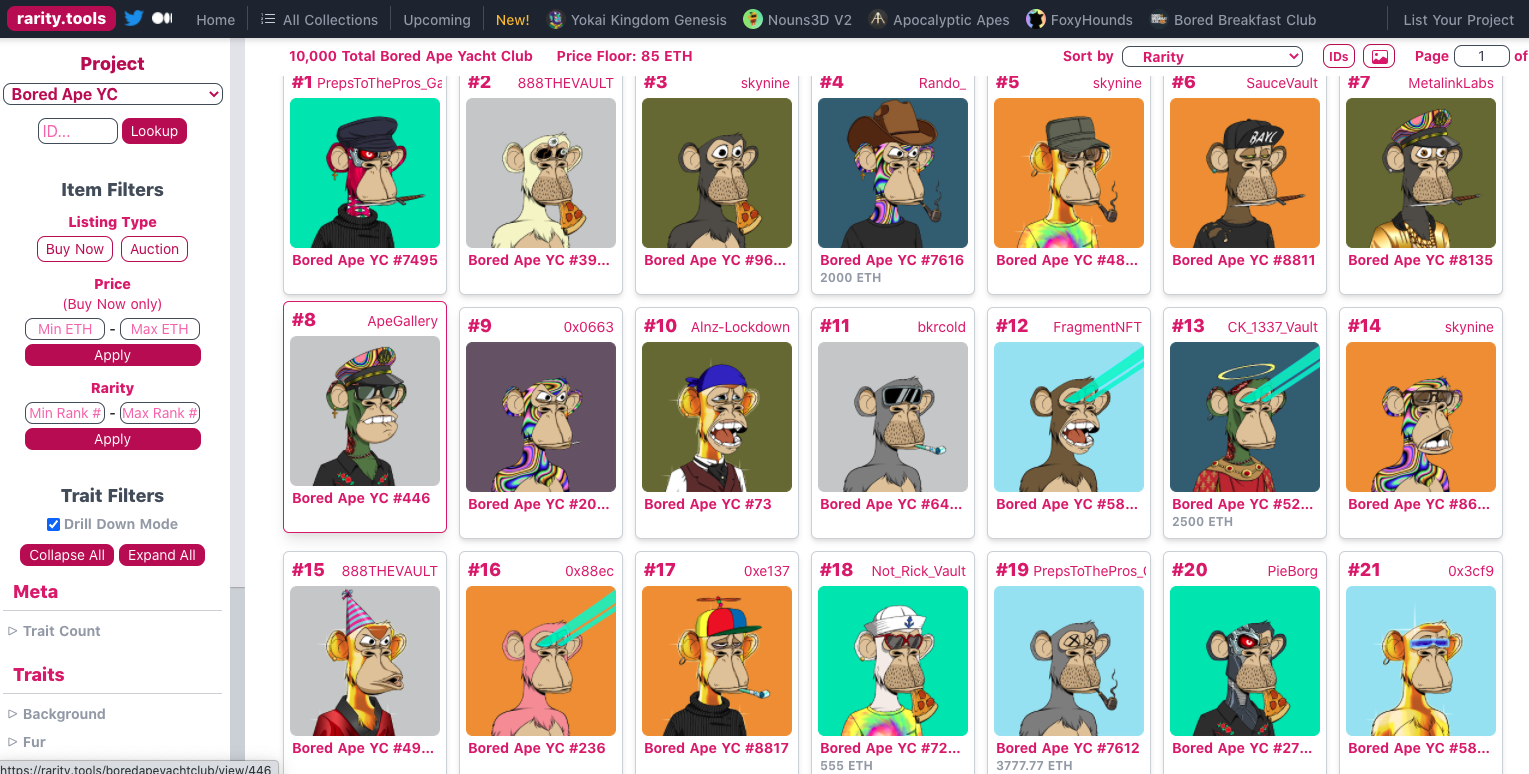

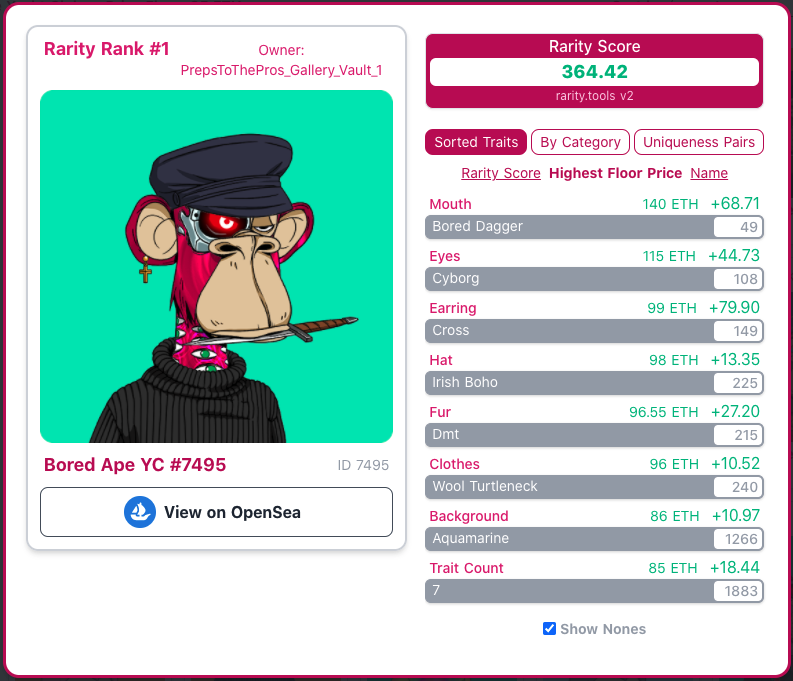

(8) How to Check Rarity of Bored Ape Yacht Club

As Bored Ape Yacht Club has grown in popularity with more and more celebrities like global soccer star Neymar (55 million Twitter followers) buying Bored Apes it’s fun to look at the rarest assets in the project.

You can check the rarity of a Bored Ape NFT by going to Rarity.Tools, searching for the Bored Ape Yacht Club collection and typing in the asset ID from OpenSea.

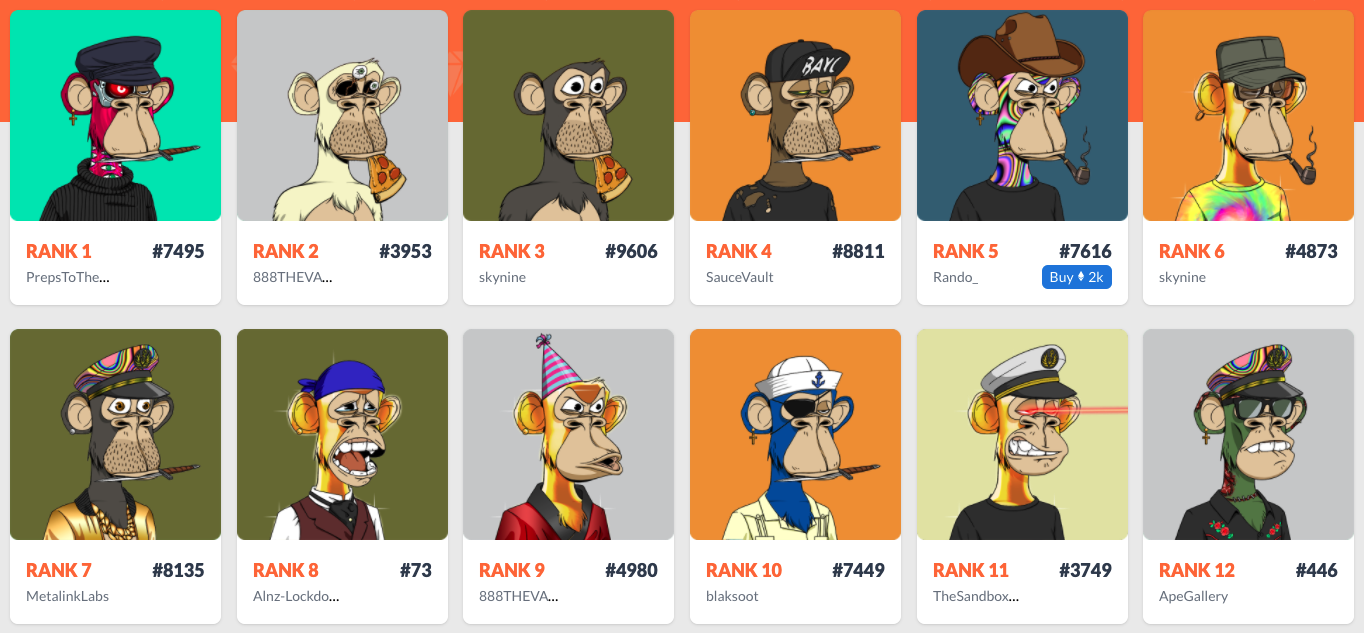

Below, we’ll look at the top 21 rarest Bored Ape Yacht Club NFTs on Rarity.Tools:

Source: Rarity.Tools

If you want to look up a specific Bored Ape for its rarity ranking, you can type in the asset ID from OpenSea on the left-hand toolbar right under the project name.

You can also click into an asset on Rarity.Tools to see what impacts its rarity ranking.

According to Rarity.Tools, Bored Ape #7495 is the rarest NFT in the project:

Source: Rarity.Tools

In this case, the combination of “Bored Dagger”, “Cyborg”, a “Cross” earring, and other traits make this Bored Ape the rarest asset in the collection.

Note: the market may not always buy purely based on a Rarity.Tools rank. As you can see in the previous picture, there are lower-ranked Apes with unique attributes that may fetch more value on the market purely due to personal preferences.

If you want a second opinion on rarity, you can head over to RaritySniper and search for the Bored Ape Yacht Club rarity rankings:

Source: Rarity Sniper

These rankings are largely the same, but there are subtle differences worth exploring if you’d like to go deep on the rarity of Bored Ape Yacht Club.

Conclusion

There were a lot of factors that contributed to the success of BAYC, but beyond timing and the NFT market maturing before our eyes, the team told a killer story through art and has continued to deliver value to the project’s holders.

It will be fascinating to see how widespread the Bored Ape brand becomes as holders take advantage of their commercial rights.

Newsletter

Enter your email address below to subscribe to my newsletter

latest posts